Our Services

Our Most Impactful Offerings.

Explore our trusted financial solutions designed to uplift rural families, support entrepreneurs, and promote inclusive growth

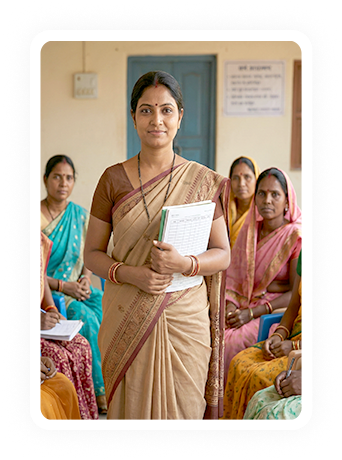

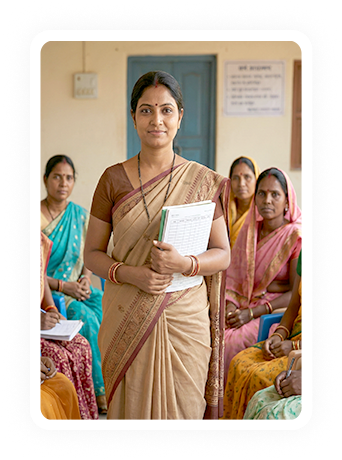

SMBG - Women's Savings Group

A collaborative savings platform that empowers rural women with financial independence and community support.

Read MoreSWEES - Entrepreneur Loans

Supportive loan solutions designed to help women entrepreneurs start, expand or strengthen their businesses.

Read MoreJLL - Joint Liability Loan

A group-based microfinance model enabling women to access credit responsibly through shared accountability.

Read MoreDDS - Daily Deposit Scheme

A convenient doorstep collection service allowing individuals to save daily and earn attractive interest returns.

Read MoreMonthly Income Scheme (MIS)

Invest once and enjoy a stable monthly income-perfect for retirees, homemakers, and long-term financial planners.

Read MoreRecurring Deposit Plan

A simple savings account connected to SMBG, offering added benefits like insurance and financial training.

Read MoreOur Journey of

Empowerment

From a humble rural banking initiative to a nationwide movement - here's how we grew, innovated, and transformed lives.

2015

Launch of Sahayog Multistate

- Registered across Maharashtra & Karnataka

- Mission to serve women, farmers, underserved & unbanked people

- Introduced Sahayog Mahila Bachat Gat (SMBG) - enabling structured savings & financial inclusion for the rural women

2019

Credit for All

- Introduced Joint Liability Loans (JLL) for women groups and small businesses

- Supported micro-enterprises, agri-linked activities & self-employment

- Strengthened trust-based lending and inclusion at the grassroots

2020

Mobility Finance Division

- Launched the Two-Wheeler Finance Scheme

- Enabled rural women, gig workers, and small traders to access mobility

- Expanded livelihood opportunities and improved connectivity

2022

Rise of Women Entrepreneurs

- Rolled out SWEES - Sahayog Women Entrepreneurship Empowerment Scheme

- Blended capacity-building, training & credit to support micro-businesses

- Empowered 35,000+ women entrepreneurs

- Expanded SMBG into the largest women's savings network in the region

2023

Urban Expansion Begins

- Entered Mumbai Zone & other urban clusters

- Connected rural women entrepreneurs to urban markets and supply chains

- Strengthened the metropolitan presence for next-generation

2024

Scaling to New Heights

- Crossed 100+ branches in Vidarbha region alone

- Strengthened presence across 7 States and 2 Union Territories

- Reached deeper into tribal belts and underdeveloped pockets with the strong footprint in Urban

- Thousands benefited through FD, MIS, DAM Duppat, SMBG, DDS, and other inclusive products

2025

Digital Core Banking Era

- Implementation of Finacle Core Banking System

- Became India's first cooperative to adopt Infosys Finacle

- Enabled seamless real-time digital banking & transparent member servicing

- Set a new benchmark for modernization in the cooperative sector

- Marked a major step with coverage of 240 branches from Himalayas to south of India

Flexible Savings, Rooted in Trust

Plans for Every Saver

From ₹ 120 to Secure Wealth

Whether you're a homemaker, daily earner, retiree, or entrepreneur - Sahayog offers a plan that grows with you.

Recurring Deposit

Build your savings step by step with monthly deposits and earn interest over time.

- Start from ₹120/month

- Flexible 6–66 month tenure

- Earn up to 8% interest

- Linked to SMBG

Fixed Deposit

Secure your funds for a fixed period and get assured returns - great for stable growth.

- Tenures from 12 months to 6 years

- Higher interest on long term

- Manual Renewal

- Loan against FD

Monthly Income Scheme

One-time deposit, monthly returns - ideal for senior citizens, homemakers, or passive income seekers.

- Monthly income from interest

- Best suited for retirees

- Assured returns

- Minimal risk investment

0L+

Women Empowered

0K+

Active Field Leaders (Sevikas)

0+

Branches Across India

Community Banking at Scale

Where Social Vision Meets Real-World Impact.

At Sahayog, every number tells a human story. Behind each branch lies a village served. Behind every Sevika stands a family uplifted. Our blend of grassroots strength and structured systems is rewriting what rural empowerment looks like..

- Women-led microfinance networks (SMBG, JLL, SWEES)

- Daily savings, doorstep service, and training

- Healthcare and insurance inclusion at village level

Easy Steps

Know Your Returns

Before You Invest

Explore our trusted financial solutions designed to uplift rural families, support entrepreneurs, and promote inclusive growth

1

Choose Your Deposit

Start by selecting the type of deposit you're interested in, whether it's an FD, RD, MIS, or DAM.

2

Enter Your Details

Input the amount you wish to deposit and the tenure to see how your money can grow over time.

3

View Your Returns

Instantly see the projected interest earnings and the total maturity amount of your investment.

Choose Your Deposit

₹5,000

Five Thousand

Faq’s

Frequently Asked

Question

Get quick answers about Sahayog's savings schemes, loan options, membership and support for women-led businesses. Learn how to join, deposit, borrow, and grow with us.

SMBG (Sahayog Mahila Bachat Gat) empowers rural women to save regularly, access microloans, and gain financial independence through collective financial practices. It promotes group accountability, economic resilience, and self-reliance.

You can join an SMBG through a registered Swayam Sevika in your village or by visiting the nearest Sahayog branch to start your group account.

Sahayog offers up to 8% interest on recurring deposit (RD) accounts linked to SMBG, depending on the deposit tenure and product type.

The Daily Deposit Scheme (DDS) can be started with as little as ₹50 per day, collected at your doorstep by a Sahayog agent or Sevika.

You can open a savings account by visiting your nearest Sahayog branch or registering through a field officer or Swayam Sevika. Standard KYC documents such as Aadhaar, Voter ID, or PAN are required.

Yes, Sahayog Multistate is a registered cooperative society under the Ministry of Cooperation, Government of India, and follows transparent, regulated financial practices.

A Joint Liability Loan (JLL) is a group-based microloan where 7 to 10 women borrow together and collectively support each other in repayments. This model encourages financial discipline and social support among members.

Under the Sahayog Women Entrepreneur Empowerment Scheme (SWEES), loans and training are offered to women-led businesses such as tailoring, grocery stores, farming, dairy activities, beauty parlours, and other micro-enterprises.

Swayam Sevika: Women who are 10th or 12th pass, respected in their communities, and committed to social upliftment. BDO: Candidates with a graduate degree and strong communication skills are preferred.

Yes, while Sahayog prioritizes women's financial empowerment, men can also open savings and fixed deposit accounts and access loan services through standard cooperative banking procedures.