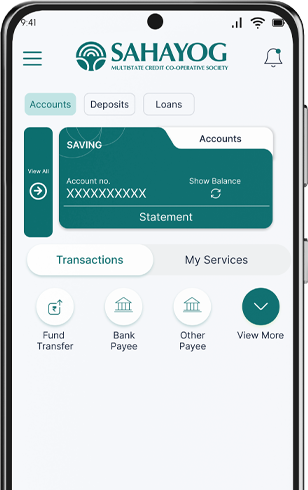

A  Joint Liability Loan That Builds Trust and Livelihoods

Joint Liability Loan That Builds Trust and Livelihoods

Access credit without collateral through collective strength. Sahayog's Joint Liability Loan enables groups to borrow responsibly, support one another, and build sustainable income-especially in rural and semi-urban communities.

Numbers That Matter for Your Financial Growth

See how our trusted services, wide reach, and member satisfaction make a difference in every financial journey.

1.8L+

Members Benefitted

Through group lending

250+

Branches Nationwide

Supporting outreach

75+

Active JLL Locations

Across multiple states

How the Joint Liability Loan Model Works

Key Benefits of Joint Liability Loan

Sahayog's Joint Liability Loan goes beyond financing-it strengthens communities, encourages financial discipline, and promotes long-term self-reliance.

- Collateral-Free Access to Credit: Members can access loans without pledging assets, making finance accessible to first-time borrowers.

- Doorstep & Centre-Based Services: Loan disbursement, repayments, and engagement are managed through regular centre meetings close to the community.

- Financial Literacy & Guidance: Borrowers receive basic financial education to manage credit responsibly and build sustainable livelihoods.

Testimonials

Voices of Growth & Empowerment

Faq's

Frequently Asked

Question

A Joint Liability Loan (JLL) is a group-based microloan where 7 to 10 women borrow together and collectively support each other in repayments. This model encourages financial discipline and social support among members.

A Joint Liability Loan group typically consists of 7–10 women who borrow together.

No. JLL is collateral-free and works on mutual guarantee within the group.

Repayments are collected weekly at group centre meetings.

JLL operates across Maharashtra, Madhya Pradesh, Karnataka, Uttarakhand, Jammu & Kashmir, and Himachal Pradesh.