A  Loan Against Deposit That Keeps Your Savings Working

Loan Against Deposit That Keeps Your Savings Working

Meet urgent needs without breaking your deposit. Borrow against your Fixed Deposit or Dam Duppat, access up to 80% of its value, and continue earning interest while using the funds.

Loan on Fixed Deposit

Up to 80% Loan-to-Value

Interest Continues on Deposit

Quick Eligibility

Numbers That Matter for Your Financial Growth

See how our trusted services, wide reach, and member satisfaction make a difference in every financial journey.

80%

Maximum LTV

Based on deposit value

250+

Branches Nationwide

Easy assistance

50K+

Deposit Holders

Across regions

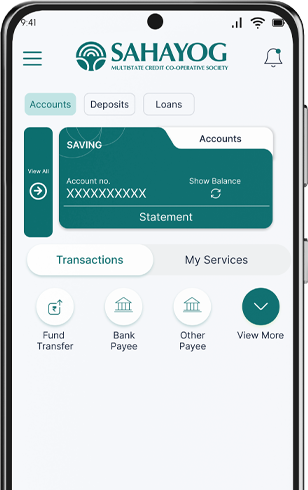

How Loan Against Deposit Works

Key Benefits of Loan Against Deposit

This facility is designed for members who need short-term liquidity but want to keep their long-term savings intact.

- FD & Dam Duppat Backed Loan: Available against eligible Fixed Deposits and Dam Duppat schemes.

- Continue Earning Interest: Your deposit remains active and continues to earn interest during the loan period.

- Minimal Documentation: No separate income proof required-the deposit itself secures the loan.

Testimonials

Voices of Growth & Empowerment

Faq's