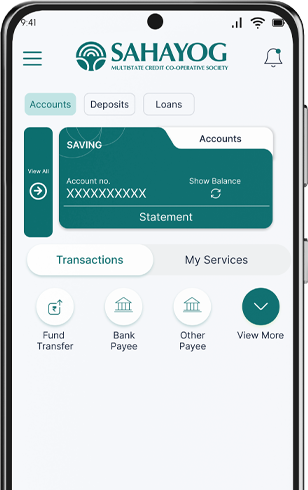

A  Recurring Deposit That Builds Financial Independence

Recurring Deposit That Builds Financial Independence

Save a small amount every month and build long-term security. This SMBG-linked Recurring Deposit combines disciplined savings with insurance protection, credit access, and skill development—designed specifically for women members.

Monthly Savings Discipline

8% Interest p.a.

Insurance Protection Included

SMBG Ecosystem Benefits

Numbers That Matter for Your Financial Growth

See how our trusted services, wide reach, and member satisfaction make a difference in every financial journey.

₹120

Monthly Deposit

Accessible entry amount

66

Tenure

66 Months Long-term disciplined savings

4Lac+

Women Beneficiaries

Across SMBG network

Why This Recurring Deposit Is Different

Key Benefits of SMBG-Linked Recurring Deposit

This Recurring Deposit goes beyond interest earnings. It supports long-term financial security, responsible borrowing, and personal development for women members.

- Assured Interest Returns: Earn interest at 8% p.a. on your accumulated savings, credited as per scheme terms at maturity.

- Accidental Insurance Cover: Eligible members receive accidental insurance cover of up to ₹25,000, adding a layer of financial protection.

- Overdraft Facility: Members may avail overdraft facilities up to 75% of their accumulated savings at applicable rates.

Testimonials

Voices of Growth & Empowerment

Faq's