A  Savings Account That Helps Your Money Grow

Savings Account That Helps Your Money Grow

Earn up to 6% annual interest with monthly credits, zero hidden charges, and a secure, fully digital banking experience designed for everyday savings.

Numbers That Matter for Your Financial Growth

See how our trusted services, wide reach, and member satisfaction make a difference in every financial journey.

6%

Interest p.a.

Up to 6% competitive savings return

250+

Branches Nationwide

Easy access across India

50K+

Satisfied Members

Trusted by our customers

Empowering Your Financial Journey with Sahayog

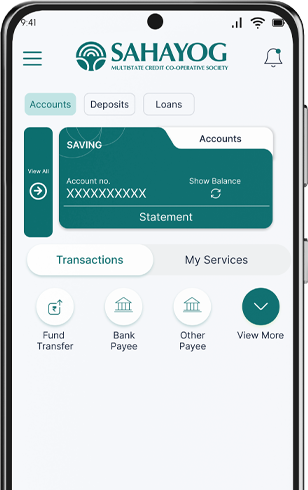

Key Benefits of Your Savings Account

Banking with Sahayog is effortless and empowering. Our digital platform gives you full control, making every transaction simple, secure, and rewarding.

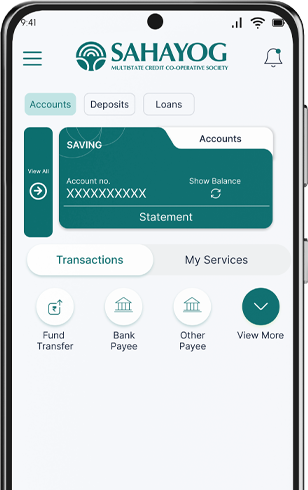

- Fingertip Mobile Banking: Check balances, transfer funds, and access statements anytime with our intuitive mobile app.

- Free & Fast Transfers: Enjoy zero charges on NEFT and RTGS with instant transfer processing.

Testimonials

Voices of Growth & Empowerment

Faq's

Frequently Asked

Question

You can open a savings account by visiting your nearest Sahayog branch or registering through a field officer or Swayam Sevika. Standard KYC documents such as Aadhaar, Voter ID, or PAN are required.

You can maintain a minimum balance of just ₹1,000, making it accessible for individuals and families.

Interest up to 6% per annum is credited monthly, giving you quicker returns compared to quarterly credit cycles in other banks.

Yes, Sahayog offers 24x7 mobile banking, allowing you to check balances and access e-statements anytime.

No. Sahayog follows a transparent policy with zero hidden charges, ensuring customer trust and satisfaction.