A  Secure & Fixed Way to Grow Your Savings

Secure & Fixed Way to Grow Your Savings

Earn assured returns with a Fixed Deposit designed for stability and peace of mind. Choose flexible tenures, lock in declared interest rates, and grow your savings without market risk.

Numbers That Matter for Your Financial Growth

See how our trusted services, wide reach, and member satisfaction make a difference in every financial journey.

10.15%

Interest p.a.

Declared fixed returns

250+

Branches Nationwide

Accessible across India

50K+

Trusted Members

Long-standing relationships

Why Fixed Deposits with Sahayog Work?

Key Benefits of Fixed Deposits

Sahayog Fixed Deposits are structured to support disciplined saving-offering stability, flexibility, and transparent terms for members at every stage of life.

- Flexible Deposit Tenures: Choose a tenure that aligns with your financial goals, ranging from short-term needs to long-term savings plans.

- Income or Growth Options: Opt for regular interest payouts for steady income, or reinvest interest to receive a higher amount at maturity.

- Safe & Transparent: Your deposits are managed under cooperative banking norms, ensuring responsible fund usage and complete transparency.

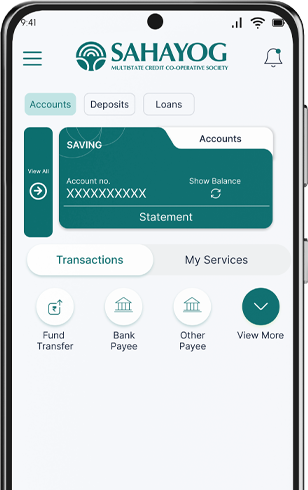

Know Exactly How Much Your Fixed Deposit Will Grow

Lock in a fixed return on your lump-sum investment and see your total interest and maturity value instantly.

1

Choose Your FD

Select Fixed Deposit to calculate how your one-time investment will grow.

2

Enter Your Amount & Tenure

Specify how much you plan to invest and for how long

3

See Your Final Value

Know exactly how much interest you will earn and what you will receive at maturity.

Fixed Deposit - Calculator

₹5,000

Five Thousand

Testimonials

Voices of Growth & Empowerment

Faq's

Frequently Asked

Question

The minimum FD tenure is 12 months, with flexible maturity options thereafter.

Sahayog offers attractive FD interest rates up 10.15% P.A as per RBI guidelines and cooperative banking policy. Rates vary by tenure.

Yes. You can avail a Loan Against Deposit of up to 80% of your FD value while continuing to earn interest. Loan amount may vary by tenure.

Yes, premature withdrawals are permitted, but interest may be adjusted as per cooperative bank policies.