A  SWEES Loan That Empowers Women Entrepreneurs

SWEES Loan That Empowers Women Entrepreneurs

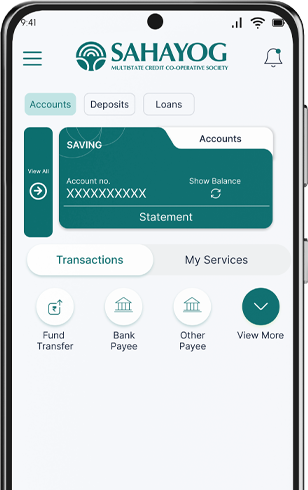

Support your business journey with confidence. SWEES provides women entrepreneurs with access to tailored financial assistance & helping them start, expand, or modernise enterprises with clarity and purpose.

Numbers That Matter for Your Financial Growth

See how our trusted services, wide reach, and member satisfaction make a difference in every financial journey.

₹3 Lakh

Loan Support

Upto ₹3 Lakh loan Based on business need

250+

Branches Nationwide

Accessible guidance

50K+

Members Served

Across regions

How SWEES Supports Women Entrepreneurs

Eligibility & Key Requirements

SWEES is designed to support responsible entrepreneurship. Applicants must meet basic eligibility criteria to ensure sustainable credit use.

- Eligible Business Types: Women-owned MSMEs, tiny units, and small enterprises engaged in manufacturing, services, or trading.

- Clean Credit History: Applicants should not be defaulters with any bank or financial institution.

- Own Contribution Requirement: A minimum personal investment of 20% of the project cost is required to ensure shared responsibility.

Testimonials

Voices of Growth & Empowerment

Faq's

Frequently Asked

Question

Under the Sahayog Women Entrepreneur Empowerment Scheme (SWEES), loans and training are offered to women-led businesses such as tailoring, grocery stores, farming, dairy activities, beauty parlours, and other micro-enterprises.

Women entrepreneurs owning MSMEs, Tiny Units, or SSIs in manufacturing, services, or trading sectors.

No. SWEES provides collateral-free loans to first-time women entrepreneurs.

Women entrepreneurs can avail loans up to ₹3 Lakhs depending on business needs.

Loan repayment tenure ranges from 12 to 36 months based on project size.