A  Recurring Deposit That Builds Savings with Discipline

Recurring Deposit That Builds Savings with Discipline

Save consistently, grow securely. A Sahayog Recurring Deposit helps you develop a habit of monthly saving while earning assured returns-making it ideal for short-term goals and planned expenses.

Numbers That Matter for Your Financial Growth

See how our trusted services, wide reach, and member satisfaction make a difference in every financial journey.

1 Year

Deposit Tenure

Simple and goal-oriented

250+

Branches Nationwide

Easy access across India

50K+

Active Members

Trusted savings relationships

Why a Recurring Deposit Makes Sense?

Key Benefits of Recurring Deposit

Sahayog Recurring Deposits are designed to make saving effortless while ensuring your money grows in a secure and transparent manner.

- Simple Monthly Instalments: Invest a fixed amount every month without the pressure of large, one-time commitments.

- Secure, Predictable Growth: Enjoy assured returns with no exposure to market fluctuations, making your savings predictable.

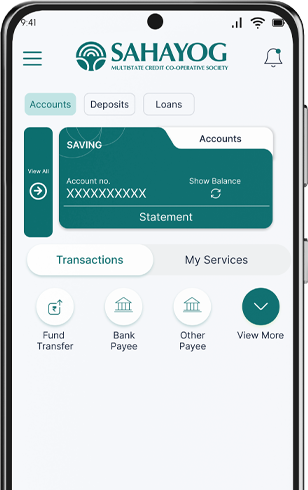

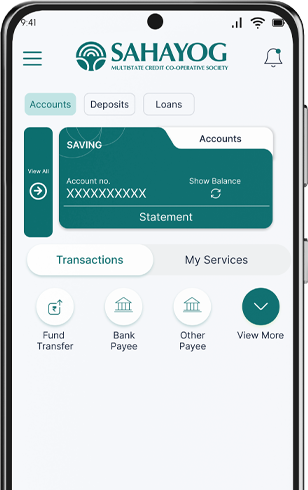

- Track Anytime, Anywhere: Monitor your RD balance and progress easily through Sahayog's mobile banking platform.

Know Exactly How Your Monthly Savings Will Grow

Plan your monthly deposits and view how disciplined saving turns into a strong financial corpus.

1

Choose Recurring Deposit

Select RD to see how your monthly deposits build over time.

2

Enter Monthly Amount & Period

Set how much you will save each month and for how long.

3

See Your Total Returns

Know exactly how much your savings and interest will become.

Recurring Deposit - Calculator

₹100

One Hundred

Testimonials

Voices of Growth & Empowerment

Faq's

Frequently Asked

Question

Sahayog offers up to 8% interest on recurring deposit (RD) accounts linked to SMBG, depending on the deposit tenure and product type.

The Recurring Deposit (RD) has a fixed 1-year tenure at Sahayog.

RD interest, up to 8% p.a., is compounded and credited on maturity.

Yes, SMBG members can open RD accounts collectively to maximize group savings. SMBG-RD is different from Normal RD

Yes, RD accounts can be closed early with applicable policy adjustments.